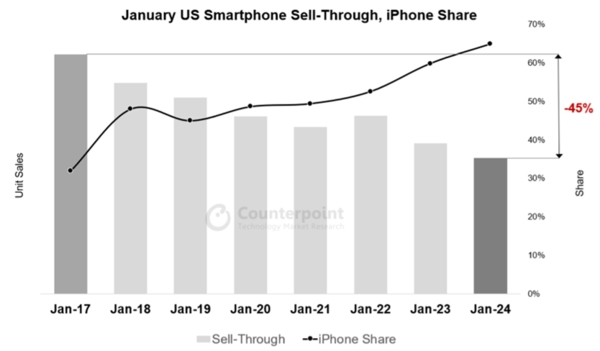

Preliminary data from Counterpoint Research’s 2024 US weekly sales tracking reveals that US smartphone market trends in 2024 indicate a 10% year-on-year decline in US smartphone sales for January. The primary factor contributing to this drop is weak performance in the low-end market. While high-end and ultra-premium segments showed relative stability, the overall smartphone replacement rate remained sluggish.

Samsung S24 series

Low-End Market Faces Challenges, Samsung S24 Series Expected to Boost Sales

Senior analyst Maurice Klaehne stated, “The low-end market, which depends on volume sales, is struggling. Many consumers are holding off on upgrades, waiting for new product releases, which has delayed the replacement cycle and negatively impacted overall sales.” However, he expects a recovery in February, particularly following the launch of Samsung’s highly anticipated S24 series.

US smartphone sales fell in January compared to the same period last year

Apple Expands Market Share Despite Overall Decline

Apple outperformed most brands in January, with its market share continuing to expand. However, sales still saw a modest single-digit decline. According to Research Director Jeff Fieldhack, “The iPhone 15 series remains a strong driver in the ‘postpaid’ market, while older models like the iPhone 11 and iPhone 12 continue to be popular among budget-conscious consumers in the ‘prepaid’ segment. This diversified product strategy has helped Apple maintain stability despite the broader market downturn.” Additionally, this approach is expected to further grow Apple’s iOS user base.

Android Phones Struggle in the US Market

Android smartphones have faced challenges in the US market for some time, especially in the budget segment. Counterpoint Research’s market monitoring data indicates that US smartphone shipments increased by 8% year-on-year in Q4 2023. During this period, Apple’s market share surged to 64%, marking its highest level since Q4 2020.

Conversely, Android smartphone shipments declined due to weak demand from low-end manufacturers. Klaehne noted, “While high-end Android phones saw slower sales growth in Q4, the biggest drop came from models priced below $300.”

Top Smartphone Brands in the US Market

As of Q4 2024, the top five smartphone manufacturers in the US market in terms of shipments are:

- Apple

- Samsung

- Motorola

- TCL

With the anticipated boost from Samsung’s S24 series and evolving consumer trends, the US smartphone market may see shifts in the coming months. However, the ongoing struggles in the low-end segment highlight the challenges faced by budget Android manufacturers. For more insights on the latest smartphone trends and market analysis, visit GearBest Blog.

Conclusion

The US smartphone market trends in 2024 indicate a dynamic shift, with premium brands holding steady while budget devices struggle. The launch of new flagship models and changing consumer preferences will be crucial in determining future market performance.