[Gearbest]In 1839, the Frenchman Daguerre successfully trial-produced the daguerreotype camera, which shortened the exposure time required to take photos from 8 hours to 20 minutes. At this point, the world's first camera was officially born. The sapling representing the camera industry sprouted from the ground and gradually grew into a towering tree over the next nearly two hundred years. All camera products in later generations can be traced back. At this point, the same is true for the professional cameras we are familiar with or the camera modules on smartphones. Now in 2023, what many people may not have noticed is that this towering tree that has grown for nearly two hundred years is undergoing an unprecedented change.

mirrorless camera

Temporarily turning the time back to ten years ago, although smartphones at that time were already equipped with cameras, which allowed users to take photos and record videos, they were limited by technology and size, and it was difficult to perform very satisfactorily. Professional interchangeable lens cameras were the best choice for image enthusiasts at that time. At that time, although mirrorless cameras had already appeared, SLR cameras were the absolute mainstream in the market because there were too many immature aspects of the former.

But times have changed, and now, ten years later, everything is different. The old mobile phone overlords, such as Nokia and Motorola, have long withdrawn from the center of the stage, replaced by a number of smartphone manufacturers such as Apple, Samsung, Huawei, and Honor. These manufacturers all attach great importance to the development of imaging technology and strive to improve the performance of smartphones in this area. Therefore, small-sized, high-quality mobile phones have successfully replaced low-end cameras in people's minds, and are quickly occupying the production space of camera manufacturers. Within the camera industry, huge changes have also taken place in the past few years.

The mobile camera wave

In September 2000, Sharp released a mobile phone product model J-SH04, which was the world's first mobile phone that could take photos, although its main camera only had 110,000 pixels. However, what Sharp, which only launched photography as an accessory function of mobile phones at the time, might not have imagined that twenty years later, many smartphones would use imaging functions as their main function, and even many netizens were Like “camera that can make phone calls.”

So far, Sony, Sharp, Xiaomi and vivo have used one-inch sensors on their mobile phones, and some of these brands have even updated their models for multiple generations. Companies such as OPPO also plan to follow in the footsteps of the above manufacturers. Huawei has brought variable aperture technology to smartphones. Specific applications currently include Huawei Mate50 series and other models. In addition, in order to solve the optical quality of the lens, some manufacturers have specially produced concept models that can use camera lenses, but they have not been publicly sold.

smart phone

Under such circumstances, photography has, to a certain extent, gotten rid of its position as an additional function of mobile phones, and many consumers have even made imaging capabilities the first consideration when buying mobile phones. Smartphones, which are both portable and have high-quality imaging systems, undoubtedly overlap with low-end camera products such as compact cameras with non-interchangeable lenses, in terms of positioning and use, and have demonstrated functions and usability that surpass the latter two, making many smartphone users no longer want to buy low-end cameras, accelerating their elimination.

The downturn in low-end cameras will undoubtedly affect the overall performance of the market. In the past 11 years, digital camera shipments have dropped rapidly from 120 million units at the peak to less than 10 million units, a drop of more than 93%. At the same time, manufacturers such as Nikon and Canon have closed their camera factories in China, and manufacturers such as Casio have already announced their withdrawal from the card camera market.

High-end cameras

It's clear that sitting still would not be anyone's first choice. Facing the impact of smartphones, camera manufacturers are also trying to find a way forward.

As mentioned before, the market share of cameras has been greatly compressed. It is obviously not an easy task to compete with smartphones, expand the market in the lower price range, and get it back on the upswing. So in this case, if manufacturers want to survive, it is undoubtedly a good choice to increase product prices and single product profit margins.

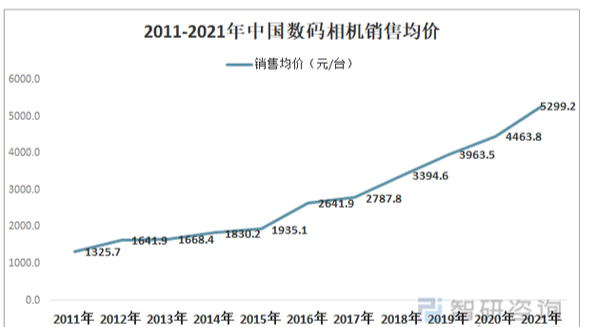

According to statistics from Nikkei, in 2022, the average unit price of global digital camera products will be about 85,000 yen, which is approximately equivalent to 4,300 yuan. In the three years of the pandemic, this number has more than tripled. According to data from the Japan Camera and Imaging Machinery Industries Association (CIPA), compared with ten years ago when camera manufacturers began to shift their main products to the high-end market, the average unit price of camera products has reached six times that of that time. In the Chinese market, this value has also increased from about 1,300 yuan to about 5,300 yuan in ten years.

related data

We can get an obvious message from these data, that is, the camera product category is constantly becoming high-end. The result of camera manufacturers' thinking is to “run away if they can't beat them” and try their best to avoid head-on competition with smartphone manufacturers in the lower price range, because there is little chance of winning, even though they may have more advantages in technology. In the high-end market where smartphones have a weak influence, camera manufacturers still have room to show their strength.

Making money is not shabby

At present, the high-end of cameras can effectively help manufacturers escape from the impact of smartphones and ensure their own profits and operating conditions. We can see this from the financial reports of several major manufacturers.

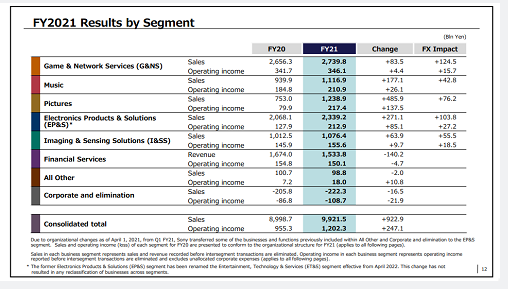

According to Sony's financial report, due to the growth of the digital camera business, their imaging and sensor solutions business increased by 6% in a single year, and operating profit increased by nearly 10 billion yen year-on-year. However, this data includes other products such as image sensors and does not reflect the situation of Sony cameras well.

Sony earnings report

According to Canon's financial report, thanks to the continued sales of many EOS R series cameras, the sales volume of Canon's professional mirrorless cameras has increased year-on-year. Revenue in the third quarter of 2022 increased by 32%, exceeding 200 billion yen. Canon said this performance was due to the increased market demand for high-quality imaging products.

Canon Financial Report

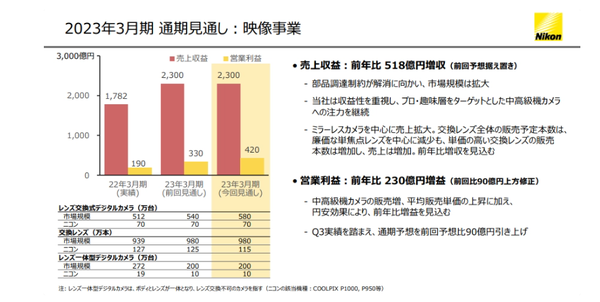

According to Nikon's financial report, Nikon's imaging business achieved sales revenue of nearly 70 billion yen in the third quarter of 2022, a growth rate of 49.4%, and profits as high as 19 billion yen, a surge of 201.6%. To this end, Nikon has also raised its expected performance for fiscal year 2022.

Nikon financial report

It can be seen that several major manufacturers have performed very well in terms of revenue and profits. However, according to CIPA data, the camera market in 2022 is still at a trough, and the overall performance is far less than that in 2019 before the epidemic. But even so, the revenue of several major manufacturers is still rising steadily.

In fact, in addition to the price increase, these manufacturers seem to have intentionally controlled product shipments over the past few years. According to information obtained by Gearbest, new popular products such as Nikon Z 9, Sony α7 Ⅳ, and Sony α7R Ⅴ were out of stock for a long time after their release, and consumers had to pay extra to buy them. During the epidemic, many older camera products also saw price increases and shortages.

The future of cameras

As an industry with a history of hundreds of years, cameras are obviously undergoing internal and external tests. In fact, there has been constant talk that cameras will eventually be eliminated from mobile phones, sometimes even from within them. For example, Shimizu Teru, president and CEO of Sony Semiconductor Solutions (SSS), predicted in a business briefing that the image quality of mobile phones will catch up with professional cameras in 2024.

Admittedly, this is indeed a trend, but it cannot be declared a “death sentence” for the entire camera industry. Because in more professional and high-end fields, the imaging capabilities of smartphones will undoubtedly be limited by their size, because no one can accept a phone that weighs several kilograms and cannot be carried close to the pocket. Cameras are a better choice. And manufacturers that have seen this have actually found their development direction for a long time to come. From the current point of view, this development direction is not wrong.

It is foreseeable that in the future camera market, low-priced products will be completely eliminated as smartphones squeeze out them, while high-end products will gradually become mainstream, and the increase in camera prices will not stop in 2023. So, is this a good thing or a bad thing?

magicCubeFunc.write_ad(“dingcai_top_0”);