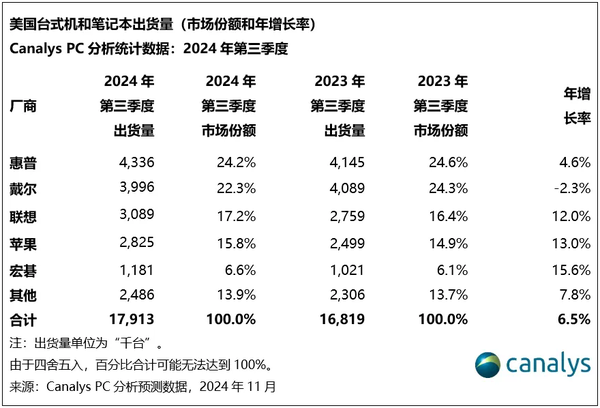

On December 26, Canalys, a leading market analysis firm, released the latest shipment data for the U.S. PC market. According to the report, Lenovo has surpassed Apple to claim third place in the U.S. PC market during the third quarter of 2024, with HP and Dell maintaining the top two spots.

U.S. PC Market Growth in Q3 2024

In the third quarter of 2024, U.S. PC shipments (excluding tablets) saw a year-on-year growth of 7%, totaling 17.9 million units. This increase was primarily driven by the rise in notebook computer shipments, which grew by 9% year-on-year. The commercial market also showed significant growth, with shipments rising by 12% in Q3, fueled by sustained demand. Windows 11 replacement upgrades continue to play a significant role in the market’s performance, and experts anticipate that the commercial sector will remain strong into early 2025.

The data from U.S. PC market shipments Q3 2024 highlights that notebook shipments continue to be a major driver of overall market growth. As commercial demand remains robust, the future of U.S. PC shipments looks promising for the rest of 2024 and beyond.

For more updates on tech trends and the latest market news, check out Gearbest Blog.

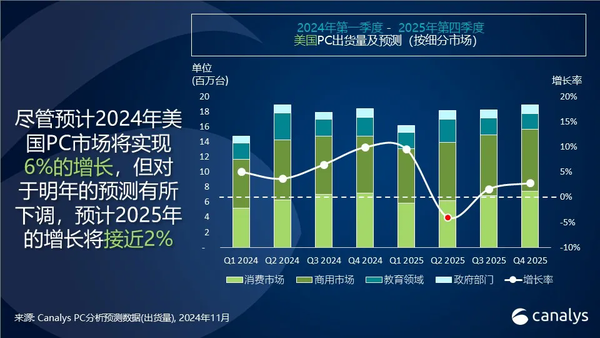

Outlook for the U.S. PC Market in 2024 and Beyond

Looking ahead, the U.S. PC market is expected to continue recovering, but at a slower pace than initially predicted. The waning momentum of the Windows replacement cycle is likely to impact growth rates. Canalys forecasts that total U.S. PC market shipments Q3 2024 will grow by 6% in 2024, reaching nearly 70 million units. However, growth is projected to slow down to 2% in 2025 and 2026 as the market stabilizes.

Top PC Manufacturers in the U.S. – Q3 2024

Canalys also released data on desktop and laptop shipments in the U.S. for Q3 2024. The top five manufacturers based on market share are:

- HP – 24.2%

- Dell – 22.3%

- Lenovo – 17.2%

- Apple – 15.8%

- Acer – 6.6%

Among these manufacturers, Lenovo’s rise to third place marks a notable shift, while Dell is the only company to experience a decline in year-on-year shipments. The other manufacturers, including HP, Lenovo, Apple, and Acer, all showed positive growth during the period.

Conclusion: A Strong Recovery for the U.S. PC Market

While the U.S. PC market continues to recover, the pace of growth is expected to slow in the coming years. The continued demand for notebooks, driven by commercial needs and Windows 11 upgrades, will support the market through early 2025. However, as the Windows replacement cycle fades, growth may level out by 2026.