[Gearbest Technology News]On March 11, TrendForce released its latest data report. Research shows that global smartphone production ended eight consecutive quarters of annual decline in the third quarter of 2023. In the fourth quarter, brands carried out year-end sprints to consolidate market share, driving smartphone production in the fourth quarter of last year to increase by 12.1% year-on-year, approximately 337 million pieces, while the full-year output in 2023 will be approximately 1.166 billion pieces, an annual decrease of 2.1%.

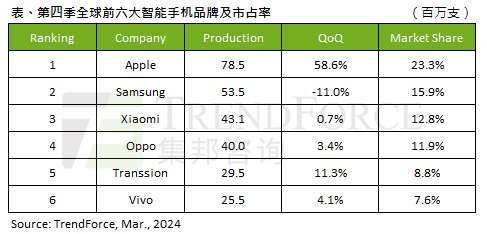

Looking at specific brands, thanks to the release of the new iPhone 15 series, Apple's fourth-quarter production increased by 58.6% quarter-on-quarter to about 78.5 million units, ranking first. The annual output was 223 million units, a year-on-year decrease of 4.2%. . However, in the face of Huawei's comeback, Apple's future sales market in China will face great challenges.

In the fourth quarter, Samsung was in the transition period for the sales of flagship phones, so its production volume decreased by 11% quarter-on-quarter to approximately 53.5 million units, ranking second. The annual output was 229 million pieces, a year-on-year decrease of 11.3%.

Xiaomi (including Xiaomi, Redmi, POCO) produced approximately 43.1 million units in the fourth quarter, a quarterly increase of 0.7%, ranking third, and its annual output was 147 million units, a year-on-year decrease of 6.1%.

OPPO (including OPPO, realme, and OnePlus) produced approximately 40 million units in the fourth quarter, a quarterly increase of 3.4%, ranking fourth. The full-year output was 139 million units, a year-on-year decrease of 4.1%.

Vivo (including vivo, iQOO) produced approximately 25.5 million units in the fourth quarter, a quarterly increase of 4.1%, ranking sixth. The annual output was 93.5 million units, a year-on-year decrease of 2.9%.

It is worth noting that Transsion (including TECNO, Infinix, and itel) produced approximately 29.5 million units in the fourth quarter, a quarterly increase of 11.3%. The annual output exceeded the 90 million level for the first time, an annual increase of 46.3%. Its quarterly and annual rankings are both Promoted to fifth place in the world. TrendForce analyzes that Transsion’s growth has not only benefited from channel inventory replenishment and products breaking away from the low-end framework and moving towards diversified development, but also includes successful operations in newly developed markets such as India and South America.

magicCubeFunc.write_ad(“dingcai_top_544”);