[Gearbest News]In 2023, many industries will begin to recover, which is also an important turning year for the smart projection industry. According to data from Aowei Cloud Network, China's household smart projector retail sales in 2023 will be 6.12 million units, a year-on-year decrease of 20.3 %; retail sales were 10.46 billion yuan, a year-on-year decrease of 33.2%. Among them, the retail sales volume of home smart micro-injection devices was 5.543 million units, a year-on-year decrease of 23.7%; the retail sales volume was 8.05 billion yuan, a year-on-year decrease of 38.4%.

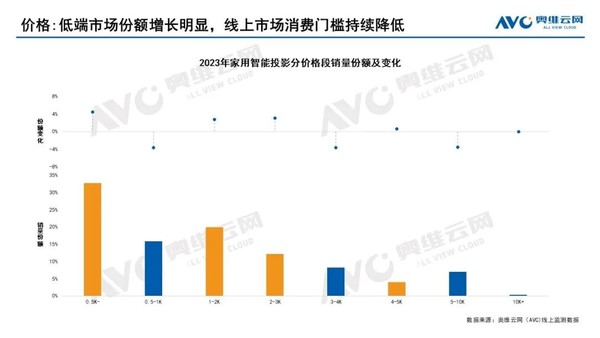

First, the proportion of low-end products has increased. According to online monitoring data from AVC, the retail sales of products priced below 500 yuan accounted for 32.8%, an increase of 4.5 percentage points from last year, and the consumption threshold in the online market continues to decrease.

At the same time, prices of laser products have also dropped. Online monitoring data from AVC shows that in 2023, the retail volume structure of the laser projection market will be differentiated by price range. The Yuan price segment is dominated, with retail sales accounting for 29.7% and 16.4% respectively. However, the retail volume shares of the 3,000 Yuan and below market and the 9-10K market both increased compared to last year.

Second, image quality is still the key to driving product sales. Against the background of sluggish market growth, ultra-high-definition products in the online market have performed well, and their volume and volume ratios have shown growth. Online monitoring data from AVC shows that the retail volume of ultra-high-definition products in 2023 will account for 5.5%, driven by price, its retail sales accounted for 21.3%. It can also be seen from this trend that image quality is still the key consideration for users when choosing smart projection products.

In addition, Damingliu has also shown considerable growth potential. It is the first choice for users. Although according to Aowei Cloud data, low-end products will become the mainstream in 2023, but from the perspective of user purchasing habits, high lumens of 3K and above have greater potential. In 2023, retail sales will account for 4.7%, and retail sales will account for 4.7%. The ratio is 15.6%.

Third, the brand structure is stable. From the perspective of brands, the top 10 brands in the online market accounted for a total of 54%, an increase of 4 percentage points from last year. Although Jimi experienced a 1.5% decline in sales, it is still in a leading position. It is worth mentioning that in the laser projection category, with its N1 series of products, Nuts accounted for 41% of retail sales and 45% of retail sales, surpassing Dangbei and ranking first in the laser projection market. Therefore, it is not difficult to see that as the growth of the market scale slows down, competition between brands is bound to intensify, and there may be some changes in the future.

Although the rapid development of the smart projection industry in the past few years has put on the brakes, the development of the smart projection industry has not stalled. The competition between brands has intensified. As the market shows a two-level differentiation trend of low-end and laser popularity, in the future The competition among smart projection brands will become more intense. Who can win in this competition will continue to be paid attention to.

magicCubeFunc.write_ad(“dingcai_top_0”);