Foxconn

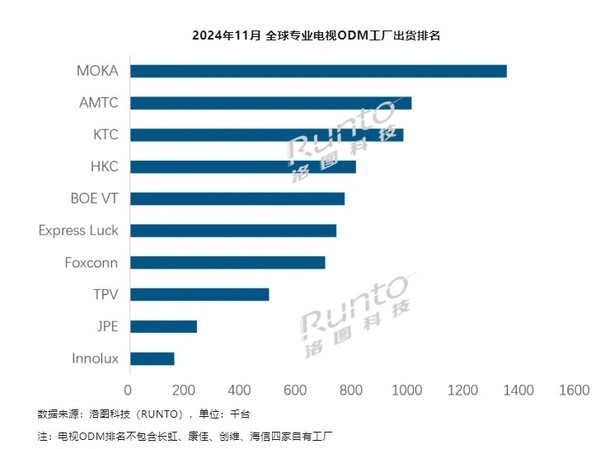

Specifically, MOKA shipped approximately 1.35 million units in November, retaining its title of champion. The year-on-year increase has exceeded 20% for three consecutive months, reaching 25.0%. They expect full-year shipments in 2024 to approach 17 million units, reflecting a year-on-year increase of more than 15%.

AMTC shipped slightly over 1 million units in November, securing second place. Its year-on-year growth rate reached 34.7%, and month-on-month growth was 10.4%. Full-year shipments are projected to exceed 12 million units, marking a 15% increase compared to last year.

KTC shipped about 1 million units in November, moving up one place from October. The company saw a significant year-on-year increase of 55.6%, with a 30.7% month-on-month growth. Full-year shipments are expected to exceed 10 million units, a year-on-year increase of more than 25%.

HKC shipped approximately 810,000 units in November, ranking fourth, with year-on-year and month-on-month growth of 68.8% and 12.5% respectively. It has been growing for five consecutive months. Cumulative shipments from January to November increased by 19.0% year-on-year.

BOE VT shipped approximately 770,000 units in November, ranking fifth, a significant year-on-year increase of 31.9%. Its domestic core customer Xiaomi’s shipments doubled that month and have stabilized at more than 300,000 units for three consecutive months.

Express Luck shipped approximately 740,000 units in November, ranking sixth, with year-on-year and month-on-month growth of 77.5% and 17.3% respectively, making it the fastest-growing professional foundry that month.

These impressive results contribute to the overall growth in TV ODM factory shipments, reflecting the strong performance of the sector. For more insights on the latest tech trends and gadgets, check out GearBest Blog.

Foxconn shipped approximately 700,000 units in November, ranking seventh, with year-on-year and month-on-month growth of 5.3% and 11.1% respectively.

TPV (TPV) shipped 498,000 units in November, ranking eighth. It has been below 500,000 units for two consecutive months, a significant year-on-year decrease of 53.2%.

The November shipments of JPE and Innolux were both around 200,000 units, ranking ninth and tenth respectively, with both year-on-year and month-on-month declines, of which Innolux had a larger decline.