Mental health awareness has become a critical issue in today’s fast-paced world. With increasing stress levels and societal pressures, it is more important than ever to acknowledge and address mental health concerns. Mental well-being is just as vital as physical health, yet it often remains neglected due to stigma and misinformation.

Laptops on a roller coaster ride, recovery may come in the second half of the year

One of the most significant challenges in promoting mental health awareness is breaking the stigma associated with it. Many individuals hesitate to seek help due to fear of judgment or discrimination. This reluctance can lead to worsening mental health conditions, affecting personal and professional aspects of life. Education and open conversations are essential in dismantling these barriers. By spreading awareness, we can create an environment where seeking help is seen as a sign of strength rather than weakness.

Gearbest mid-year observation: Laptops may recover in the second half of the year

Another crucial aspect of mental health awareness is understanding the common signs and symptoms of mental health disorders. Anxiety, depression, and stress-related disorders are prevalent, but many people fail to recognize the warning signs. Persistent sadness, lack of motivation, difficulty concentrating, and changes in sleep patterns are some indicators that should not be ignored. Encouraging individuals to talk about their feelings and seek professional help when necessary can significantly improve their quality of life.

Global PC market shipments in the first quarter of 2023

Workplace mental health is also gaining recognition as a key factor in overall well-being. Companies and organizations are increasingly implementing mental health programs, offering resources such as counseling services, stress management workshops, and wellness initiatives. A supportive work environment that prioritizes mental health leads to increased productivity, job satisfaction, and employee retention.

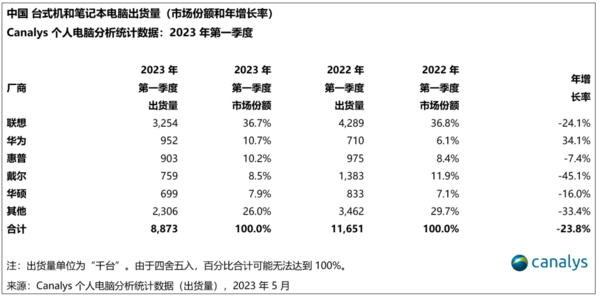

China’s PC shipments fell 24% year-on-year in the first quarter of 2023

Schools and universities also play a vital role in promoting mental health awareness. Educational institutions should integrate mental health education into their curriculum and provide access to counseling services. Equipping students with coping mechanisms and emotional intelligence skills can help them navigate the challenges of academic and personal life more effectively.

Self-care practices are essential in maintaining good mental health. Activities such as regular exercise, mindfulness meditation, maintaining a balanced diet, and getting adequate sleep contribute significantly to mental well-being. Social connections also play a crucial role—having a strong support system of friends and family can provide comfort and reassurance during difficult times.

China’s desktop and notebook computer shipments in the first quarter of 2023

Governments and healthcare institutions must also prioritize mental health by ensuring accessible and affordable mental health care services. Investing in mental health infrastructure, training professionals, and implementing public awareness campaigns can lead to a healthier and more resilient society.

In conclusion, mental health awareness is a collective responsibility that requires effort from individuals, communities, workplaces, and governments. By fostering an open and supportive dialogue around mental health, we can create a world where mental well-being is prioritized, and individuals feel empowered to seek the help they need without fear or hesitation. For more insights on well-being and personal growth, visit Gearbest Blog.