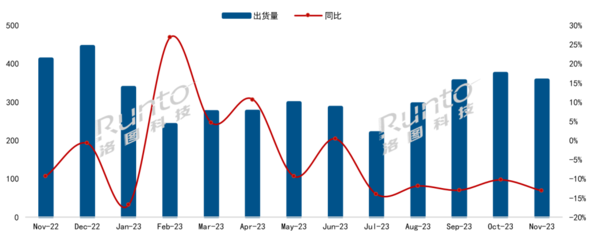

[Home Secret]China's TV market will fall into a downturn in 2023. Shipment data in November showed that the total market volume was 3.57 million units, a month-on-month decrease of 4.5% and a year-on-year decrease of 13.2%. This trend was particularly obvious in the second half of the year, with year-on-year declines exceeding 10% for five consecutive months. Total shipments in the first 11 months fell by 6.6% year-on-year.

After the Double Eleven promotion, the market did not usher in recovery. According to online monitoring data from RUNTO, from October 16 to November 12, the retail volume of online public retail channels in the Chinese TV market fell by 21.8% compared with the same period last year. Although the average price increased by 29% year-on-year, retail sales were basically the same as last year.

In terms of brands, the main brands in China's TV market are still Hisense, TCL, Xiaomi, Skyworth, Changhong, Konka, Haier and their sub-brands. The total shipments of these brands in November were approximately 3.335 million units, a year-on-year decrease of 11.9% and a month-on-month decrease of 4.2%. Their combined market share has remained at a high of 93% for five consecutive months.

Among the first-camp brands, Hisense won the first place that month with shipments of more than 800,000 units, but it fell 8.0% year-on-year. TCL's shipments were approximately 800,000 units, a new high for the year and the same as last year. Xiaomi's shipments are close to 700,000 units. This year, their strategy has shifted to upgrading their product structure and increasing operating profits. Skyworth's shipments exceeded 600,000 units, a year-on-year increase of more than 10%.

Among the brands in the second camp, the combined shipment volume of the three brands Changhong, Konka, and Haier was approximately 500,000 units, a year-on-year decrease of 30.5%. Despite declining sales, traditional brands still have product advantages. Changhong released the world's first StarLight TV with super-connectivity capabilities in November, and has comprehensively laid out the entire industry chain including StarLight chips, StarLight modules, StarLight terminals and system solutions.

Regarding other brands, Huawei's shipments continue to be sluggish, with total annual shipments falling by more than 40% year-on-year. The total shipments of four foreign brands, Sony, Samsung, Philips and Sharp, continued to be less than 200,000 units, a year-on-year decrease of nearly 20%.

Overall, China's TV market will face the dual challenges of volume reduction and brand differentiation in 2023. Market demand continues to be sluggish, with sales showing a double-digit year-on-year decline. RUNTO has further lowered its forecast for full-year shipments in 2023, which is expected to be within 37 million units, a year-on-year decrease of approximately 7%. As the market situation changes, brands will need to adopt proactive strategies to respond to challenges and seek opportunities for growth and innovation.

magicCubeFunc.write_ad(“dingcai_top_0”);