A few years ago, if a company could become an Apple supply chain company, it seemed to mean that the company had boarded the express train of rapid growth and became a “newcomer” in the supply chain field. Even if the company had worked diligently for many years before that, becoming an “Apple supply chain” would make you an emerging technology company. This is of course inseparable from Apple's brand effect and the public's perception of Apple.

However, in recent years, as Apple's product innovation has been weak, people have entered a period of fatigue with its products. Fewer and fewer people care about the new product features that have not changed much, but negative news about Apple has become a topic of conversation. Therefore, problems in the supply chain due to various reasons have also become a new topic of conversation about Apple, not to mention that a company that has been cooperating with Apple for nearly a decade has suddenly encountered a limit-down storm, which naturally attracted the attention of many people.

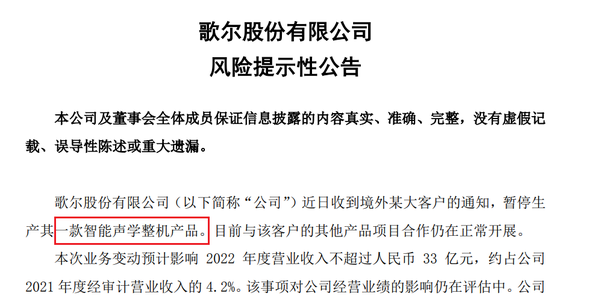

Goertek's risk warning announcement (source: Internet)

The reason is that on November 8, Goertek Co., Ltd. issued a risk warning announcement on the Shenzhen Stock Exchange. At the beginning, it pointed out that Goertek received a notice from a major overseas customer to suspend the production of one of its smart acoustic complete machine products…. This business is expected to affect the revenue amount of 3.3 billion yuan, accounting for 4.2% of the audited revenue in 2021. The specific impact is being evaluated. Subsequently, Apple analyst Ming-Chi Kuo released preliminary investigation results, saying that the smart acoustic complete machine product that Goertek suspended production may be Apple AirPods Pro 2, and the reason for the suspension of production is more likely to come from Apple's order cuts. If it is because Apple's flagship product iPhone 14 series this year has cut orders because sales did not meet expectations, it is understandable, but then Ming-Chi Kuo pointed out that another supplier, Luxshare Precision, has obtained all orders for AirPods Pro 2, so it can be speculated that this may be related to the poor quality of AirPods Pro 2, but it is not known when Goertek will be able to resume production and whether it will affect Apple's orders next year.

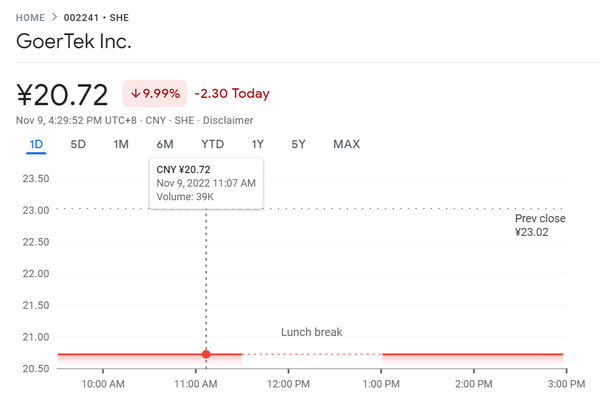

Goertek shares hit the limit down at the opening (Source: Internet)

After a series of events, Goertek's stock price fell to the limit at the opening on November 9, with more than 3.4 billion yuan in queue funds, causing the company's market value to evaporate by nearly 8 billion yuan in one day. For a time, there was a constant stream of news that “Goertek may be removed from the Apple supply chain.” It is reported that the root cause seems to be related to the previous market rumors that the yield rate of AirPods Pro 2 manufactured by Goertek was not high, and it faced the risk of being fined by Apple. Goertek also responded on the same day, saying that rumors such as being kicked out of the Apple supply chain were obviously rumors. The company only suspended one product of the customer in response to demand, and the rest of the projects were in normal cooperation. The company is still evaluating the specific losses. Later, industry insiders said that overseas companies have extremely strict requirements on the yield rate of products. Although it is not known whether it is related to product design, it is difficult to meet their requirements due to cost control. However, due to their huge orders, it is difficult for people to be willing to take risks.

The yield rate of AirPods Pro 2 is worrying (source from the Internet)

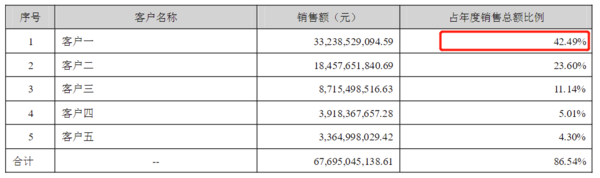

In December 2021, Goertek's market value reached a high of 198.7 billion yuan, making it a star company in Apple's supply chain. On the other hand, it also reflects that Apple, as Goertek's largest customer, plays a vital role in its performance growth and market valuation. It is reported that the business provided by Apple once accounted for 50% of Goertek's business revenue.

Whatever the reason, we can see that the companies in the “Apple chain”, due to their high degree of integration with Apple and high dependence on its business, have to bear the risks from Apple at the same time. The risks related to Apple's revenue and corporate image also affect the upstream supply chain companies.

Apple's share of Goertek's revenue (Source: Internet)

These companies are not only Goertek, but also include O-Film, AAC Technologies, Lens Technology, Compal and many other companies. Joining Apple's supply chain has brought growth or even doubled the business, and has achieved great success on paper. However, when Apple has unilateral changes or credit risks, the first to be tested is still the supply chain companies. In fact, this is not only true for Apple, but also for other mobile phone manufacturers and even hardware manufacturers. In addition, in the mobile phone industry, manufacturers almost occupy most of the profits. Just like companies like Apple, because they can grab the most benefits, they can control the market and have absolute voice. Supply chain companies can live well even if they “don't eat meat, but only drink soup”. This is why countless companies are willing to be “exploited” and “dependent” on Apple.

But this is the reality. According to Apple's official third-quarter financial report, Apple's overall revenue reached $90.1 billion, still maintaining excellent growth, but the cost expenditure has not changed much, which means that the supply chain industry has not brought substantial revenue growth due to Apple's sales growth. For Apple, the supply chain is an absolute buyer's market, and Apple controls everything.

Apple has always been very strict with its supply chain. It changes its supplier list every year to cause competition among supply chain companies. For example, the latest list of suppliers updated by Apple has been reduced from 200 to 191, among which some leave and some come, and some leave and come again. Therefore, it is not an exaggeration to say that Apple's practice is “raising poison”. In this regard, Apple and Tencent have many similarities. For example, in order to limit the control of Samsung and LG over screens, BOE was introduced to squeeze and exploit the profits of supply chain manufacturers and control absolute discourse power.

The gross profit margin of “Apple chain” manufacturers has been declining year by year

Therefore, as a supply chain manufacturer, it is necessary to re-examine its position in the industry and actively seek opportunities to discover new companies or industries to reduce dependence on individual buyers. For example, Quanta Computer, a company in Apple's supply chain, announced last year that it would no longer undertake Apple's Apple Watch and iPad because “growth and profits are limited, and the gross profit margin is only 3%-4%.” We can also see from Goertek's financial report on the smart acoustic machine business that the gross profit margin of this business with Apple is also declining year by year. As of 2021, the gross profit margin is only 10.2%, which is lower than the overall gross profit margin of Goertek's other businesses. Xinwanda, whose battery orders were replaced, turned around and took over Xiaomi's orders, and its revenue increased by 36% that year.

We can see that for supply chain manufacturers, joining Apple's supplier list is bound to be an extremely favorable competitive advantage for them, and will inevitably bring further growth to the company, but at the same time, they face greater risks and unpredictable changes. This is not a business with only benefits and no harm. When the main business is strongly bound to a company, they can either strive for “amnesty” or think of a way out. After all, there is no mercy in business behavior. When the day comes when the relationship turns against each other, all these years of mispayment will be mispaid.

magicCubeFunc.write_ad(“dingcai_top_0”);