【Gearbest Technology】It seems that since the “mask” period, the entire camera market has gradually become magical, and shortages and price increases have become an indispensable part of the new product release. Recently, this situation has become more and more serious.

On March 1, Fujifilm's new camera X100 VI was officially launched. On the eve of the launch, more than 1 million people made reservations to buy it on JD.com and Tmall. Those who made reservations needed to obtain the purchase qualification through a lottery before they could purchase it through official channels. However, information on the Tmall platform shows that the first batch of Fujifilm X100 VI stock is only 80 units. JD.com did not release the stock data, but it should be roughly the same. Based on this calculation, the winning rate of Fujifilm X100 VI's first sale purchase qualification is less than one in ten thousand, which is lower than the popular Maotai. If you really win the lottery, it is recommended to ignore the camera and turn left to the lottery store next door.

Such a low winning rate naturally brings rich returns. Gearbest noticed that on the day of the release, the price of Fuji X100 VI soared. After the official channels such as Tmall and JD.com were out of stock quickly, the third-party channels posted a high price of 17,500 yuan on the same day, and many winning consumers chose to resell on second-hand platforms such as Xianyu, generally increasing the price to 16,000 yuan. You know, the official price of Fuji X100 VI is only 11,000 yuan, and you can make half of it by reselling it within one day. Without discussing the financial value, the sales of Fuji X100 VI are obviously pathological. However, in today's camera market, it seems to be expected.

Out of stock and price increase are part of the Japanese camera industry. If you are not happy, you don't have to buy it.

The last wave of “good times” in the camera market seemed to be in 2019. CIPA data shows that since 2020, the sales volume of the camera market has fallen for three consecutive years, and it was not until 2022 that it began to gradually recover. However, in the past few years, the sales environment of camera products has changed a lot. Out of stock and price increase have become the inevitable road when new cameras are released. This is not only the case for Fuji mentioned above, but also for several major brands such as Sony, Canon, and Nikon.

To give a few examples, in October 2021, Sony α7M4 was released. Its predecessor, Sony α7M3, is a benchmark for full-frame cameras, and the configuration of Sony α7M4 is also excellent. However, in terms of supply, this successor has completely failed to keep up with its predecessor. After the release, the Sony α7M4 was out of stock for a “year”. As an official channel, Sony Mall only has one purchase qualification a month, and consumers must make an appointment to buy it. The release time of Nikon Z 9 is similar to that of Sony α7M4. As a flagship product with a single body price of 35,999 yuan, the price of Nikon Z 9 has also been “letting go” for a long time. It has been above 40,000 for a long time, and it did not drop until shortly before the release of Z 8.

There may be some reasons for the new cameras, but many old cameras are out of stock and have increased in price, such as the Sony α6400, which makes it hard to hold back. This situation has also spoiled the atmosphere of second-hand trading platforms. There is a saying that “cameramen's first pot of gold is selling equipment.” Users who have made this pot of gold in recent years are lucky. Many cameras can even be sold at a higher price after using them for a few years. Most other digital products cannot compare.

The country is in decline? Then drain all the fish out of the pond!

In recent years, mobile imaging of products such as mobile phones has developed rapidly, which has seriously impacted the position of the camera market. In terms of products, it seems that some manufacturers are already preparing smartphones with M43 frame sensors. In terms of marketing, many young people are already accustomed to using mobile phones to take photos and videos, and cameras are fading out of the public's field of vision and becoming “professional equipment” in the cognition of many people. And “professional” also means “niche”. Therefore, the camera itself has become an industry that is declining. As mentioned earlier, the sales volume of the camera market in 2022 has increased, once exceeding the sales volume in 2019, but this is more like a rebound after an oversold due to objective reasons.

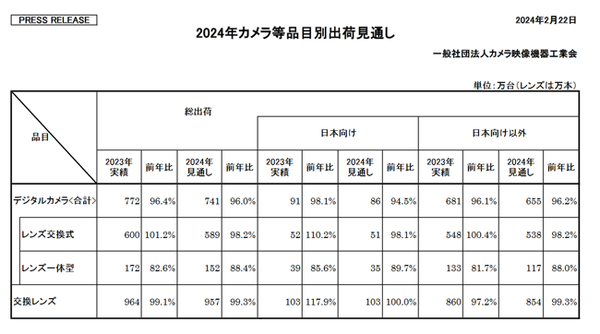

On February 22, CIPA released a new report showing that the total shipments of digital cameras in 2023 will be 7,720,505 units, only 96.4% of 2022, and once again on a downward path. Among them, only the Chinese market performed well, with shipments in 2023 being 124.7% of 2022, while Japan was 98.1%, the rest of Asia (excluding Japan and China) was 98.2%, Europe was 80.8%, and the Americas was 94.3%, all bleak. CIPA predicts that global camera shipments in 2024 will be 7.41 million units, only 96% of 2023, and will continue to fall.

It is certain that the camera market will shrink for a long time in the future. For manufacturers, managing the existing user base has become an important way to survive. Out-of-stock, price increases, or more bluntly, “hunger marketing” have become a good means. Otherwise, it is difficult to explain why the production capacity of manufacturers is collectively strained when the total sales volume of the camera industry is declining. It is difficult to say how the overseas market is doing, but referring to Fuji X100 VI, this set is very popular in China, and even this C-format camera with non-interchangeable lenses can be sold for 17,000.

There is still a lack of domestic competitive education

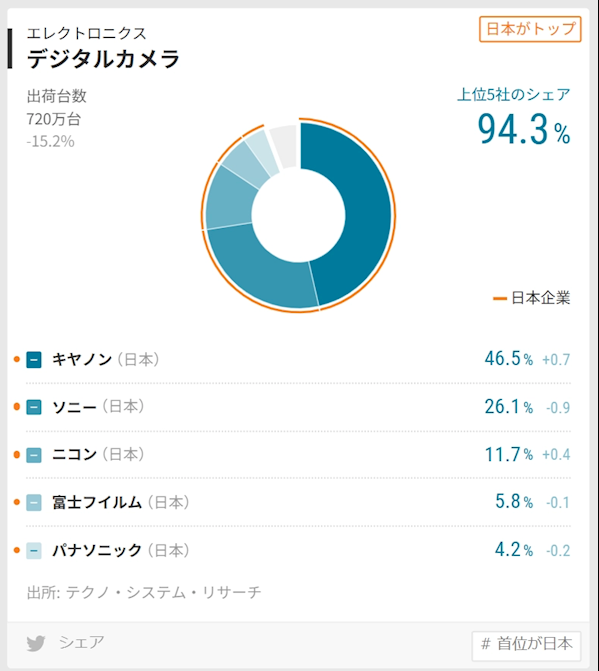

The main reason why several major Japanese camera brands can run out of stock and raise prices unscrupulously is their absolute control over the market. According to data from the Nikkei Industry Map 2024 Edition magazine, in the global camera market in 2022, Canon's share was 46.5%, Sony's was 26.1%, Nikon's was 11.7%, Fuji's was 5.8%, and Panasonic's was 4.2%. The top five camera brands are all Japanese brands, and together they occupy 94.3% of the market. The data for 2023 has not been released, but there is no strong rise in the industry, and the overall situation should be similar to that in 2022.

It is lucky for Japan that an industry is like this, but it is not lucky for consumers. Today, as a sunset industry, it is difficult for us to see several major manufacturers in the camera industry facing relative situations. Competition is definitely there, but it is superficial. For example, Fuji X100 VI, is Fuji really out of stock? Some media reported that Fuji X100 VI had started production three months before its release. According to production, Fuji X100 VI had at least 60,000 units in stock at the time of release, but Tmall officially only released 80 units. And what are the reactions of those Japanese friendly companies? It seems that only Ricoh GR3x, which has been out of stock for several months, is suddenly in stock, but what's the use of this?

Looking at the smartphone, electric car, memory chip and other industries next door, we can only say that the camera industry still lacks a strong enough Chinese manufacturer. Imagine if there was a Chinese manufacturer like Huawei or Xiaomi in the industry, then why would millions of Chinese people need to fight for 80 cameras? How could the winning rate of Fuji X100 VI be less than one in ten thousand? Unfortunately, there is no sign of such a domestic manufacturer appearing so far.

magicCubeFunc.write_ad(“dingcai_top_0”);