[Gearbest Technology]Recently, the domestic digital circle has not been peaceful. Gearbest noticed that multiple sources said that the Huawei P70 series will be released soon and is expected to debut in April this year. Although Huawei Mate70 series and Xiaomi 15 series are both products that will be released in the second half of the year, news has begun to leak out. Domestic mobile phone manufacturers are frequently launching flagship models, which shows that manufacturers have greater ambitions for the high-end mobile phone market this year.

After careful combing, Gearbest found that although the configurations, routes, and characteristics of each domestic flagship are different, they also have consistent actions. A domestic CMOS manufacturer seems to be gradually replacing Sony and Samsung as the first choice for domestic flagship mobile phones.

According to reports, the Huawei P70 series standard version and Huawei P70 Pro will abandon the use of Sony sensors and instead choose Howe’s OV50H as the main camera. At the same time, cooperation between many domestic manufacturers such as Huawei, Honor and Xiaomi and OmniVision are deepening. Both parties are customizing sensors, which are expected to be used in the Huawei Mate70 series and Xiaomi 15 series that will be released at the end of the year. In addition, Howe’s one-inch sensor will also be released soon, which will replace Sony IMX989, Sony LYT900 and other sensors in the market.

After seeing these news, many netizens became curious. Able to punch Samsung and kick Sony, this manufacturer is by no means an unknown person. In fact, this CMOS manufacturer, which has been gradually favored by several major domestic mobile phone manufacturers, actually has a lot of background.

Past and Present

In 1995, OMNIVISION Technology was born in Silicon Valley. Interestingly, although this company was founded in the United States, its four founders are all Chinese. One of them is Chen Datong, a well-known figure in the domestic semiconductor industry. Just two years after its establishment, Howe launched the world's first single-chip color CIS, which was very influential in the early mobile phone CMOS market.

When camera phones first started to be used in 2003, Omnivision's products were the most influential. One-third of the world's mobile phone cameras used Omnivision sensors. From 1998 to the end of 2004, Omnivision shipped a total of 190 million CMOS image sensing components, and its products and customers are all over the world. However, what goes up must come down. As Apple gave up using Omnivision's products and kicked it out of the supply chain, and competitors such as Sony and Samsung continued to encroach, Omnivision began to decline. In 2016, Omnivision was acquired and delisted by a Chinese consortium, and then in 2019 it was transferred to Weill Holdings. Today, Haowei's R&D and business focus are in China, and it is a truly domestic company.

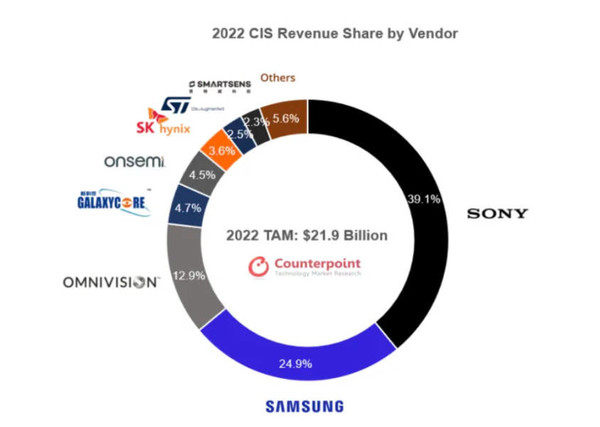

Data shows that in the global CIS market in 2022, OmniVision is the third largest company after Sony and Samsung, occupying a full 12.9% of the market. At the same time, in the global automotive CIS market in 2022, ON Semiconductor and OmniVision ranked top two in terms of market share, with 44% and 30% respectively, far ahead of Sony and Samsung in this type of market.

full bloom

2019 seems to be the time when Sony has the most stable position in the smartphone CMOS market. At that time, IMX586, like Qualcomm's Snapdragon 8 series mobile platform, had almost become a standard feature for flagship models built by various Android manufacturers. But at the same time, Haowei is also dormant. After Howie was acquired by Weill in 2019, its ties with various domestic Android phone manufacturers have become increasingly close.

In 2020, Xiaomi launched its first-generation digital series Ultra model. For the first time, its main camera did not use a Sony Samsung sensor, but Howe's OV48C. According to the official introduction, OV48C is a flagship mobile phone image sensor with 48 million pixel resolution, 1.2 micron pixel size, high speed and high dynamic range. Although there are very few models using OV48C, with the help of Xiaomi 10 Ultra, Haowei has also begun to reopen the domestic high-end mobile phone market.

After 2020, the high-pixel wave swept the mobile phone industry, and Howey further launched the OV64 series of CMOS products. Among them, OV64B is the most popular and is used by many models such as OPPO Reno series and realme digital series. Even flagship models such as Huawei's Mate series also use this sensor to create telephoto cameras. Nowadays, OV64B appears on new phones from various manufacturers from time to time, becoming a longevity sensor on the market. At the same time, OV50H has replaced IMX766, IMX890 and other products, becoming the best choice for manufacturers to build flagship main cameras this year, such as Xiaomi 14, Huawei P70 and other models.

Looking to the future

On March 19, the OV50K40 sensor was officially released. It is the world's first smartphone image sensor using TheiaCe technology. A single exposure can achieve a dynamic range close to the human eye level. In terms of parameters, the OV50K40 still has 50 million pixels natively, has a 1/1.3-inch outsole, a pixel area of up to 1.2 microns, and supports four-in-one pixel output of 12.5 million pixels, bringing stronger photosensitivity. The frame rate supports 120 frames/second and 60 frames/second (HDR), enabling full 50-megapixel Bayer output, high-quality 8K video and 2x crop zoom function.

The advent of the OV50K40 sensor is another sharp knife for Howe to further cut the market share of Sony and Samsung. The first model of this sharp knife is Honor’s Magic6 Pro. Moreover, according to the news learned by Gearbest, Honor is not the only manufacturer that will use OV50K40. In the future, we will see it appear on more domestic flagship phones.

Since Huawei encountered sanctions, China's smartphone industry has gradually launched a wave of localization. Nowadays, BOE, TCL CSOT, and Tianma have replaced Samsung, and the once popular Samsung OLED screens have almost disappeared from domestic flagship models. In the field of mobile phone CMOS, Haowei has become the next “BOE”. It is foreseeable that there will only be more and more companies like “Howe” and “BOE”.

magicCubeFunc.write_ad(“dingcai_top_0”);