For the cleaning appliance industry, this is the most complicated era.

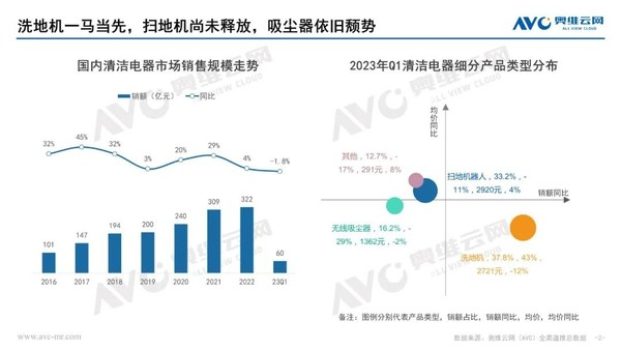

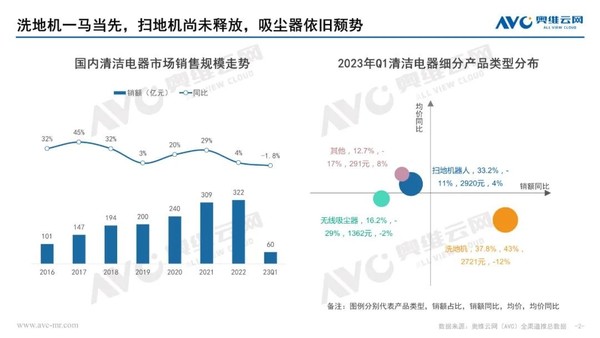

In the past few years, the health awareness stimulated by users has driven the demand for cleaning, and the cleaning appliance category has experienced explosive growth. Especially in 2021, the cleaning appliance category is at its highest prosperity in the period, with annual retail sales in the industry increasing by 29% year-on-year.

However, after the explosive demand, the industry growth rate gradually slowed down. According to data from Aowei Cloud, the omni-channel retail sales of cleaning appliances in 2022 will be 32.2 billion yuan, a year-on-year increase of 4.0%, and the retail volume will be 25.48 million units, a year-on-year decrease of 14.5%.

In fact, after the outbreak of every emerging category in the home appliance industry, growth slowdown is an inevitable stage it needs to face. Therefore, for many cleaning brands, they need to face a very real problem: How to find a way to break out in the era of involution?

Floor washing machine becomes a must-answer question

Judging from the general trend of the home appliance industry, all categories have entered a new normal of seeking growth based on existing stock. However, if we seize structural opportunities, we can capture new deterministic growth opportunities. And this “opportunity” for the cleaning appliance category lies in On the floor scrubber. According to data from Aowei Cloud, the annual retail sales of the floor washing machine market in 2022 will reach 9.97 billion yuan, a year-on-year increase of 72.5%, far exceeding the overall growth rate of 4% in the cleaning appliance industry.

Entering 2023, the trend of floor washing machines is still strong. Data show that in the first quarter, omni-channel sales of floor washing machines were 2.26 billion yuan, a year-on-year increase of 43.%, overtaking sweeping robots to become the largest subcategory of cleaning appliances, accounting for 37.8%. At this point, the floor washing machine has officially become a veritable “top class” in the cleaning appliance industry.

The reason why floor scrubbers can grow rapidly and become the “backbone” of cleaning appliances is mainly because they meet two major prerequisites:

First, on the product side, technological maturity has led to the evolution of product capabilities.In 2016, the American brand Hoover launched a wet and dry vacuum cleaner. Although it is called a vacuum cleaner, it functionally integrates vacuuming and mopping. However, due to the immaturity of the motor technology, it cannot be realized. It is waterproof, so once the motor absorbs water, it will easily break.

But with the maturity of waterproof motor technology in 2019, the floor washing machine can perfectly deal with wet garbage, and there will be no problem of product damage due to water intrusion into the motor. It has technically solved the development obstacles. With the layout of Tianke, this The market size of similar products has gradually begun to explode.

Secondly, on the demand side, the usage scenarios are more comprehensive and cleaning efficiency is higher.At present, the main floor environment in domestic households is still composed of hard floors such as wooden floors and floor tiles, which provides suitable usage scenarios for floor washing machines. At the same time, in household cleaning, sweeping + mopping are basically necessary options. The floor washing machine not only meets this rigid demand well, but can also further simplify the cleaning process, which undoubtedly meets the needs of users very well.

At the same time, although the current sweeping robots have good obstacle avoidance and cleaning capabilities, we have to admit that their performance is still not perfect in some scenes. The floor washing machine, with its manual light assistance, has a good improvement in cleaning effect and efficiency compared to the floor sweeper. Therefore, it has become the more popular one at the moment.

In addition, the lower cost threshold for learning and use has also accelerated the rapid explosion of the floor washing machine market to a certain extent. Although the sweeping robot can “liberate” its hands, it is also constrained by intelligence. It requires frequent technical upgrades to enhance the intelligent capabilities of the product, thereby enhancing the product's cleaning capabilities and efficiency. However, this also makes its price rise. Currently, the top sweeping robots The price of the robot is close to 10,000 yuan, but from the perspective of operation, there is still not much change. It needs to draw maps, set cleaning plans, etc. The floor washing machine is not as high a threshold as a sweeping robot in terms of price or cost of use. It only requires a few buttons to operate, which lowers the threshold for middle-aged and elderly users.

It is the combination of the above factors that has led to the rapid development of floor washing machines. It can be said that in the changes in the cleaning appliance industry, floor washing machines have rushed to the “front line”. As their market share continues to rise and the scale of users continues to expand, floor washing machines are no longer the “first line” of cleaning appliance brands. Optional question”, but a required question.

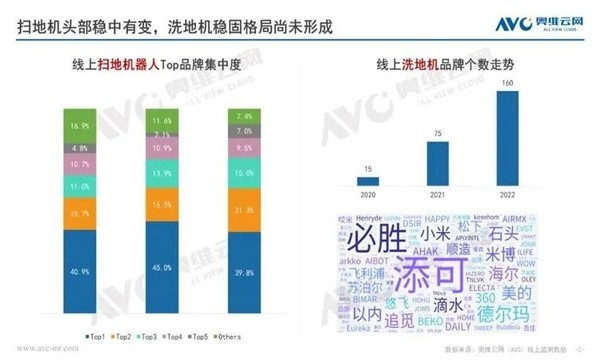

Although the solutions are different, innovation is still the main direction

The dividends of floor sweepers are obvious, which naturally attracts many companies to compete for layout. According to data, the number of brands entering the floor washing machine industry has increased from 15 online in 2020 to 160 in 2022. The current layout of enterprises has also expanded from companies focusing on clean home appliances such as Tianke, Zhuimi, and Shitou to comprehensive home appliance companies such as Midea, Fotile, and Haier. Even Internet companies such as Xiaomi and 360 also have layouts.

The surge in entrants has also intensified competition in the industry. Therefore, how to differentiate products and further expand the market has become a common problem faced by brands. For now, mainstream brands have given different answers to this must-answer question:

The first category is that functional integration highlights product comprehensiveness.

In recent years, functional integration to highlight the versatility of products has become one of the main directions of innovation in the field of home appliances. The floor washing machine market has also continued this trend, and among such brands, Timco is one of the representatives. As the first player in the country to lay out floor washing machine products, it has a first-mover advantage in the industry and has accumulated a large market advantage. In order to expand the scale of the floor washing machine market, it has continuously strengthened its product capabilities.

The Fuwan 2.0 Slim, launched in 2021, combines a vacuum cleaner and a floor scrubber into one, further meeting users' cleaning needs for different scenarios. On this basis, the Fuwan Space Station will be launched in 2022, which can achieve functions such as automatic flushing, automatic water replenishment, and intelligent self-cleaning, further simplifying user costs.

Starting from the Fuwan 1.0 series, Timco floor scrubbers have gradually formed a core selling point with intelligence. While focusing on basic cleaning functions, they have also begun to provide users with corresponding solutions for different usage scenarios. The continuous optimization and integration of its capabilities have enabled it to remain the leader in floor scrubbers today.

The second category is focused on structural differentiation.

In terms of product innovation, not only the optimization of form and appearance, some brands have begun to innovate on deeper structures, and the main representative company among this type of brands is Mibo. In the past, the key prop that was indispensable for mopping and washing the floor was the “mop”, and Mibo's floor washing machine pioneered the use of a roller-free cloth design. It is reported that with FOTILE's original “high-energy bubble washing” on the sink dishwasher, the product can still wash the floor without a rolling cloth. At the same time, thanks to FOTILE's accumulated experience in vacuuming and cavity design in range hoods, Mibo The product also has good suction capabilities, allowing good floor cleaning without a mop.

In addition, the design of the rubber roller brush does not have certain advantages when using it, especially since there are some products on the market with poor self-cleaning ability, which results in the need for frequent cleaning of the roller cloth. The design of the rubber roller brush not only saves the need for frequent cleaning Changing the rolling cloth can also avoid problems such as secondary contamination of the rolling cloth, easy mold and smell, and the need for manual drying.

Today, Mibo also maintains a compact product development rhythm. Since the release of the first roller-free floor scrubber last year, three 7-series products were released in May this year, targeting different user groups, and a product matrix focusing on roller-free scrubbers has been initially formed.

The third category is independent innovation in core technology.

In the field of smart cleaning, every company focuses on investing in core technology research and development, and the most representative company in research and development is Chumi. After entering the smart cleaning industry, Chaimi focused more on building its own technical “barriers.” According to its official website, as of early March 2023, Chaimi Technology has applied for 3,431 patents worldwide, including 1,311 invention patent applications, 299 PCT applications, and has obtained a total of 1,729 authorized patents.

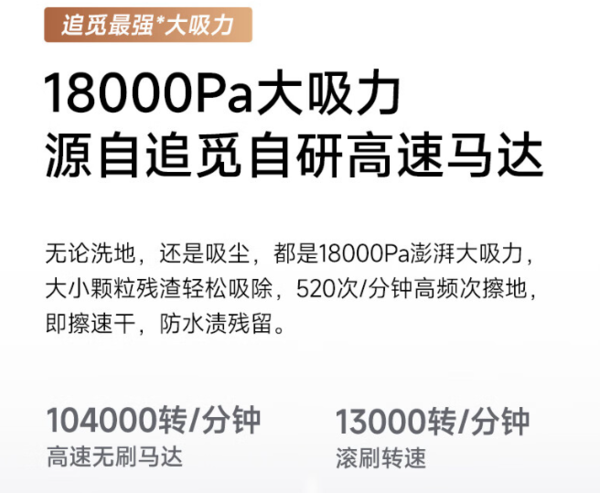

Among them, the high-speed digital motor technology mastered by Chuimi is the key to determining the suction strength of cleaning appliances such as floor washers and sweepers. Now the suction power of Chuumi H13 PRO PLUS MIX can reach 18000Pa, which has also become the core technology of Chuumi in building its own The key to competitiveness.

The answers to the problem are different between brands, but in the final analysis, the main direction is the same: continuous innovation in products, forming their own barriers in technology, and thus building their own moat.

New thinking is needed after brutal growth

For hardware products, in the early stages of development, new demands are almost created after the maturity of related technologies. At this stage, product strength is largely an important driving force for higher sales and higher market share. However, as time goes by, the expansion of market scale gradually slows down, and the industry will also usher in a wave of disorderly competition.

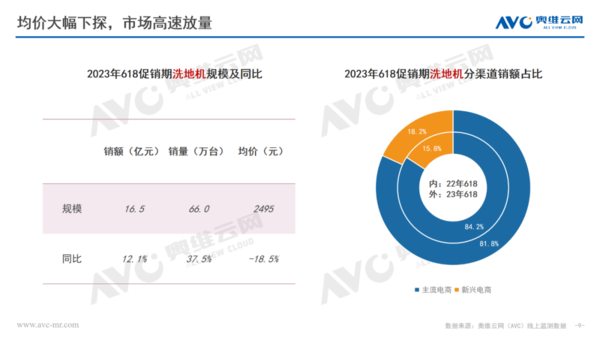

At present, there are signs of a “price war” in the floor washing machine industry. According to data from Aowei Cloud Network, the average price of 618 floor washing machines this year fell by 18.1% year-on-year. In comparison, the average price of sweeping robots fell by 4.2% year-on-year. %.

As the industry gradually matures, it is reasonable to use the “price-for-volume” approach to continue high growth. However, it should be noted that with the change in the consumption environment, more and more consumers are becoming more rational, and washing The floor machine is a cleaning tool that requires manual assistance. Its capabilities can still be achieved using traditional, low-cost methods. Some consumers think it is a dispensable product, and “price-for-volume” cannot help. Industry changes this issue.

Therefore, for floor washing machine companies, “exchanging price for volume” is a feasible strategy, but they need to think about how to make the life cycle of floor washing machines longer, or even build them into traditional home appliances such as washing machines and air conditioners. Same. We can’t just focus on short-term share growth. We must start from the consumer perspective and build it into a product that is in urgent demand. Only in this way can we raise the upper limit of the brand and the industry.

magicCubeFunc.write_ad(“dingcai_top_0”);