[House Secret News]Wu Xiaobo wrote in the opening chapter of “Thirty Years of Turbulence”: The turbulent story of this book began in 1978.

For the dishwasher industry, 1978 was also a special year worth remembering. Although the first dishwasher patent appeared in 1850, the real popularity of household dishwashers began in 1978, when Miller Company manufactured the world's first microcomputer-controlled dishwasher, making the relationship between man and machine More closely, the household usability of dishwashers has been better reflected, so more and more dishwashers have entered Western households.

For the domestic market, the concept of dishwashers first appeared in the late 1980s. At that time, many brands such as Macro and Jingmei launched related products. However, due to various factors such as price and low demand, the market was closed. Production was discontinued one after another not long after.

In 1995, the dishwasher market started again in my country. Foreign brands such as Jinding, Feige, Siemens, Jinzhang, LG, and Oudi entered the Chinese market with their products. During this period, manufacturers successively entered the Chinese market through joint ventures or technology introduction. Producing dishwashers, the market for dishwashers has initially taken shape.

However, as an “imported product”, it is not that simple for dishwashers to take root in China. Due to different eating habits, the products of foreign brands at that time were not optimized for localization. For some greasy tableware, there was a problem of “not being able to be washed clean at all”, and “wasting water and electricity” has also become a problem when dishwashers are popularized. the problem we are facing.

With the development of dishwasher technology and the upgrading of people's consumption, the scale of the dishwasher market has gradually expanded, and more and more families regard dishwashers as “standard equipment.” Taking this opportunity, domestic and foreign home appliance brands have innovated dishwasher technology and upgraded dishwasher services to seize market growth space.

Foreign brands recede

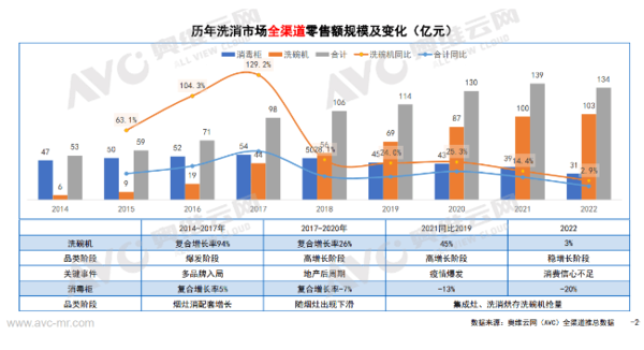

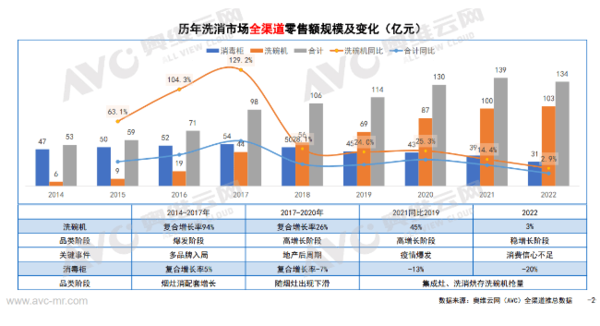

Since 2018, my country's dishwasher market has continued to expand, but the growth rate has experienced a volatile decline. By 2021, the growth rate has dropped by 6.45% from the peak of 127.91%. By 2022, the industry has experienced its first annual decline since 2013. Negative sales growth. The market size is slowing down. In this process, the market brand structure has shown an obvious trend of strong domestic products and weak foreign investment.

Dishwasher is an “imported product”. This attribute determines that the early market was mainly dominated by foreign home appliance brands. However, as the market shows good growth, more and more domestic brands are accelerating the product iteration and upgrade of their own dishwashers. , directly competing with foreign home appliance brands.

In such a competition, the advantage of foreign brands in taking the initiative in the market by virtue of their first-mover advantage is gradually diluted. In terms of market share, offline sales of foreign brands led by Siemens will account for less than 41% in 2022, which is almost half compared to the 80% market share in 2015.

The reason why this situation occurs is nothing more than two points:First, the competitiveness of old products has declined; second, new products have insufficient cost performance.

Take Siemens, which has the best market performance, as an example. As the first foreign brand to enter the Chinese dishwasher market, it has always focused on the high-end market. At the beginning of the industry's outbreak, there was no problem with this approach. After all, there were not many in the market at that time. A brand that can compete with it in terms of technology accumulation and brand reputation.

This has also enabled Siemens to quickly capture the hearts and minds of a large number of Chinese consumers with its international innovative design, globally unified production and testing standards and high-quality products. Therefore, in the stage of market expansion, Siemens dishwashers have achieved outstanding results despite their high prices.

However, as time goes by, the technological leadership of foreign brand products has gradually diluted. Coupled with the localization advantages of domestic brands and the rising popularity of national fashion consumption, they have been greatly impacted.

For example, the two best-selling models of Siemens and Midea in 2022: Siemens SJ558S06JC and Midea P60. The latter has a lower price and is better than Siemens in terms of capacity and number of sprinkler heads. In addition, Midea P60 also supports high-temperature cooking and washing, which can better deal with large oil stains and other stains on tableware.

The rise of product power coupled with cost-effective advantages has caused the market competitiveness of foreign brands to begin to decline sharply. For consumers, when choosing a dishwasher, product price, performance and a sense of brand belonging are indispensable. But now, foreign brands have no advantage in these three aspects.

From leading to gradually moving to the edge, it is a fact that foreign brands themselves are not living up to expectations, but it cannot be denied that the strong rise of domestic brands has contributed to the fuel.

The wave of innovation among domestic brands

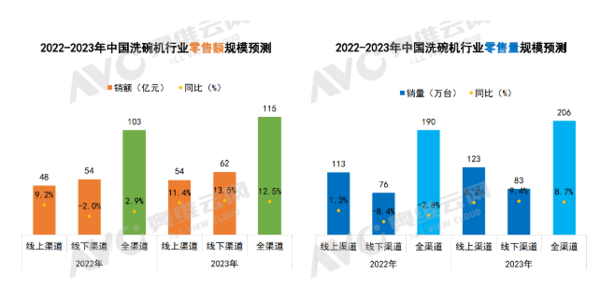

From the perspective of the external environment, dishwashers have become an important starting point for kitchen appliance brands to seek growth. Even many integrated stove companies have begun to integrate dishwasher capabilities into their products, trying to achieve growth through this. Not only kitchen appliance companies remain optimistic about the development of dishwashers, but data agencies are also optimistic about the future trend of dishwashers. Aowei Cloud predicts that the dishwasher market size in 2023 will be 11.3 billion yuan, a year-on-year increase of 10.5%.

Behind the improvement of the market, domestic brands are also holding on to their own trump card – product strength.

for example,Fotile's form technology is grasped by both hands, and sink-type dishwashers + high-energy bubble washing technology drive forward.In 2015, FOTILE launched the world's first sink dishwasher, leading the first wave of localization of the dishwasher category, making the dishwasher more suitable for Chinese-style kitchens with limited space; in 2021, FOTILE launched its first High-energy bubble washing built-in dishwasher. As the first technology brand in China's dishwasher industry, high-energy bubble washing breaks away from the “pure water washing” technical thinking of previous dishwashers and ends the era of Western-style cleaning technology for dishwashers.

Nowadays, high-energy bubble washing has entered the 3.0 era. Through “one peeling, two flushing and three washing” and the structure of star spray arm, it can better solve the stains that are difficult to clean in Chinese kitchens.

Vantage's self-developed V-Wash high-pressure washing and “dry” black washing technology.In 2018, Vantage proposed the concept of “dry state” for the first time. Through special internal design, it avoids the problem of residual moisture in the tableware and inner pots after washing. It not only solves the storage problem after washing, but also opens up the “dishwasher” A new path of “integrated cleaning, decontamination, drying and storage”.

In addition to dry washing, Vantage also has its own secrets in terms of cleaning capabilities. V-Wash high-pressure washing technology has now developed to the third generation. It relies on innovative 12-wing counter-rotating four-spray and variable-speed boosted direct-drive pumps. With the blessing of multiple clean black technologies, it can reach a super first-class water efficiency level and achieve a cleaning index of 1.16.

Haier focuses on cleaning, pioneering double-sided washing and upgrading steam washing.Haier's dishwasher industry pioneered “double-sided washing” technology, which can achieve double-sided washing and clean front and back washing effects through the upper and lower water flows of the H-shaped middle spray arm. This makes it different from the straight-shaped spray arm of traditional dishwashers. It wraps and rinses tableware on both sides, so that each side can be cleaned. The water pressure exceeds 50,000Pa for the first time, and the cleaning ability is stronger, with a cleaning index of 1.16.

In addition, Haier also has its own unique advantages in steam washing, achieving 80°C micro steam to break down stubborn oil stains, and then using continuous high temperature micro steam for a second rinse to inhibit the growth of bacteria.

Through innovation, domestic dishwasher brands have allowed their products to cross the threshold of “easy to use”. And when a dishwasher goes beyond “easy to use” and truly becomes “practical”, for users, it is a product that they can't go back to after using it. Therefore, the dishwasher market may see a certain price drop in the future, stimulating consumption and triggering a new round of positive cycle of cost reduction, thereby rapidly increasing the penetration rate.

Dishwasher technology competition will become more intense

The rise of every emerging thing generally follows four stages: introduction period, rapid growth period, maturity period and decline period.Looking at the development history of dishwashers in China for more than 30 years, the development generally follows this law, but it is also full of its own unique characteristics. So far, it can be roughly divided into: introduction of cooling period, low-speed climbing period, and steady growth period.

The reason why dishwashers have such a unique trend can actually be summarized as two reasons:

First, product prices are too high.When dishwashers first entered the Chinese market, they had a very real problem: they were “expensive”. According to relevant data, the average price of traditional large appliances in 2015 was around 2,000-3,000 yuan, while the average price of dishwashers reached 5,600 yuan. In the environment at that time, it could hardly be called a mass consumer product.

Second, there are “shortcomings” in product form and capabilities.In addition to the price, looking at the product size, the dishwasher did not have many optimizations for Chinese-style kitchens in the early days. It still continued the large size of European and American products, and it was difficult to integrate into Chinese-style cabinets. In addition, in terms of product capabilities, Chinese cooking methods are not only varied, but also the sizes of pots and pans are different. As a result, European-style dishwashers cannot meet the needs of consumers in terms of cleaning power and tableware placement.

It is precisely because of the above two reasons thatThere is a certain “blind spot” in matching the supply and demand of dishwashers. In big cities, land is at a premium and dishwashers take up more space. Small cities with larger kitchens are less receptive to new things, which makes the development of dishwashers more difficult. In the early days, the users faced were mostly high-net-worth individuals who were not sensitive to price.

Nowadays, this situation has changed. Whether it is from the perspective of mass consumption level, living environment, product form or product price, dishwashers have the prerequisites to become mass consumer goods, even for price-sensitive users , among domestic brands there are still products with good product quality and matching prices.

Against this background, dishwasher user acceptance has begun to rise, and the industry may enter a period of accelerated penetration.In this process, it is almost inevitable that the halo of foreign investment will recede and domestic brands will rise. This is not only driven by market demand, but also the accumulation and explosion of domestic brands in the dishwasher industry chain.With the decline of foreign brands, future competition in the dishwasher industry will focus on technological innovation and service differences. Trying to meet the life needs of post-90s family users will become the key to brand competition.

So looking back,On the one hand, as product competition intensifies and the margins of product capabilities blur, the internal structure of dishwashers will accelerate the clearing of the tail market, with the strong ones becoming stronger, highlighting the Matthew effect; on the other hand, the existence of user experience between foreign brands and domestic brands The gap will further widen. With the combined efforts of both the supply side and the demand side of dishwashers, the market influence of domestic brands may be further strengthened.

Today, the dishwasher industry has reached another critical node. For industry brands, how to provide users with better and more value increments is testing every company. It is believed that with the joint efforts of leading local brands, domestic dishwashers will demonstrate strong tenacity and endogenous development momentum in the subsequent development.

magicCubeFunc.write_ad(“dingcai_top_0”);