[Secret Home News]The field of clean appliances, which has been experiencing rapid growth in the past few years, has seen its growth momentum gradually slow down. According to GfK data, in the first half of 2023, the retail sales of the cleaning appliance market increased by 5.5% year-on-year to 17.7 billion yuan.

In the past three years, the retail sales of cleaning appliances have maintained a rapid double-digit growth year-on-year, and the rapid development speed is obvious to all. Nowadays, against the background of the slowdown in the development of cleaning appliances, Zhaimi has also discovered some changes in the industry.

First, floor washing machines overtook floor sweepers and became the number one category in the industry.

For a long time in the past, sweeping robots have been the “face” of cleaning appliances. With its good cleaning ability and hands-free characteristics, it has become the first choice for many families to choose cleaning appliances. However, with the emergence of floor washing machines, it quickly seized the market share of floor sweepers by virtue of its “mopping and washing” features. Now, it has surpassed it and become the main driving force for the advancement of the cleaning appliance industry.

According to GfK data, in the first half of 2023, the scale of floor scrubbers surpassed sweeping robots and ranked first in the cleaning appliance market, with a share of 40.1% and a year-on-year growth rate of 32.9%. It also ranked first in the sub-category. . The market share of sweeping robots was 35.9%, down 0.6% year-on-year.

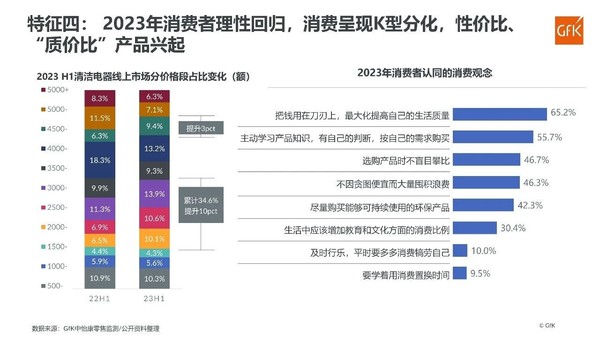

Second, consumption trends are polarized, with low- and high-end products continuing to sell well.

As consumers become more rational, consumption gradually returns to value-driven. Against this background, the phenomenon that has emerged in the industry is the polarization of consumption, with the sales proportion of low- and high-end products gradually increasing. According to GKF data, in the cleaning market in the first half of this year, the proportion of the mid-to-low market price of 1,500 yuan to 3,000 yuan (including 1,500 yuan) increased to 34.6%, an increase of 10 percentage points compared with the same period last year; 3,500 yuan to 5,000+ yuan (including 4,000 yuan) Yuan)'s high-end market share has also increased, with a share of approximately 36%.

In fact, it is not difficult to understand that such a situation occurs. For mass consumers, entry-level products with relatively low prices do not have much burden on users in this price range when making consumption decisions. Therefore, brands should target them to create standards. Products, focusing on cost-effectiveness, have the opportunity to further expand their own market space; on the other hand, the increase in the high-end market share means that there are still consumer groups that pay more attention to product quality and are able to accept high-premium products, and products suitable for them have more segmented needs. , while equipped with products with higher configurations.

However, I need to remind you that there has never been an absolute “king” category in the cleaning appliance industry. New categories will be born every once in a while, such as the sweeping robots in the past and the floor washing machines today. This situation occurs because as the popularity of the product deepens, the shortcomings of the product will become more obvious. Today's floor washing machines have the problem of balancing cleaning effect and lightness.

Therefore, for cleaning appliance brands, while enjoying the dividends brought by floor washing machines, it may be time to rely on user needs to prepare for the next round of product innovation.

magicCubeFunc.write_ad(“dingcai_top_0”);