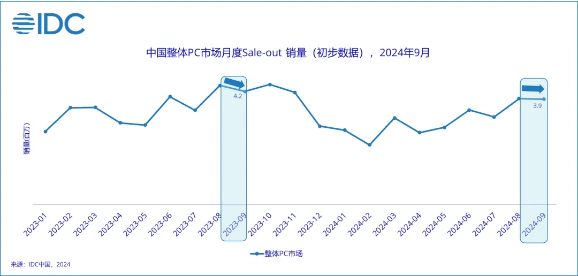

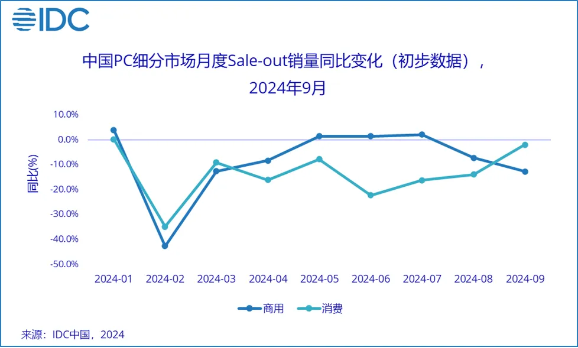

On October 15, IDC released its latest “Sale-Out” Track Report on China’s PC market. The data reveals that in September 2024, overall PC sales in China declined by 6.9% year-on-year. Despite the general downturn, signs of recovery are emerging in the consumer and small-to-medium enterprise (SME) segments (companies with fewer than 500 employees). In contrast, large enterprises (over 500 employees) and government education sectors continue to struggle due to budget constraints.

Key Drivers of PC Sales Growth in China

IDC’s analysis attributes the rebound in the consumer and SME markets to two major factors:

- Gaming Boom with Black Myth: Wukong

The global PC industry is entering a new phase of growth, with blockbuster games like Black Myth: Wukong driving demand for high-performance gaming laptops and desktops. The increasing popularity of gaming has significantly contributed to the China PC market rebound in recent months. - China’s Old-for-New Trade-In Policy

To stimulate consumer spending, China has introduced a nationwide trade-in policy, encouraging consumers to exchange old PCs for new ones. This initiative extends across various sectors, including education, manufacturing, and healthcare, as well as consumer segments such as automobiles, home improvement, and smart home technology.In August, seven government departments, including the Ministry of Commerce, refined the policy framework and allocated funds for implementation. Shortly after, major cities like Beijing launched local subsidy programs, offering 15%-20% discounts on new PC purchases. This financial incentive has successfully boosted consumer interest and accelerated PC sales growth in China.

Short-Term Impact and Market Outlook

IDC forecasts that this policy will inject short-term vitality into China’s PC market throughout the second half of 2024. The combination of subsidies and upcoming shopping festivals, such as “Double Eleven,” is expected to further drive PC sales in October.

However, the long-term sustainability of this growth remains uncertain. The subsidy program’s impact may weaken in early 2025 as budgetary constraints and the global economic climate influence consumer spending. Additionally, there is a risk of market saturation, where demand is temporarily overstimulated and then declines.

Long-Term Market Growth Factors

While government policies provide immediate relief, IDC emphasizes that sustainable growth in the PC market must come from deeper industry trends. Key factors influencing long-term PC sales growth in China include:

- The global economic recovery and its effect on consumer purchasing power.

- The natural upgrade cycle of aging PC hardware.

- The rise of AI-powered PCs (AIPC), which are expected to shape the next generation of computing.

Although short-term fluctuations may occur, as China moves further into the post-pandemic era, the effects of temporary policy interventions will gradually diminish. The future of the China PC market rebound will ultimately depend on evolving consumer demands, technological advancements, and broader economic conditions.

For more insights on the latest tech trends and product recommendations, visit GearBest Blog.

By monitoring these trends, industry players can better position themselves to capitalize on the next wave of growth in China’s dynamic PC market.