[Gearbest Technology]Intel has faced a series of challenges in recent years, and the sudden resignation of CEO Pat Gelsinger is only the latest chapter in its ongoing struggles. Gelsinger, who took the helm in 2021 with the goal of turning the company around, has now left the company less than four years into his ambitious plan. While Intel initially announced his retirement, sources from Reuters, Bloomberg, and the New York Times suggest that the board had actually pushed him out due to unmet expectations and disappointing progress.

Three and a half years ago, Gelsinger announced an ambitious plan to turn around the struggling chipmaker within four years — and now, he’s reportedly been pushed out of the company before completing the plan . It happened so suddenly that Intel didn’t pick a successor, and it happened so completely that Gelsinger wouldn’t even stay on as an adviser. He said goodbye to Intel once and for all.

Intel has been in disarray for years. It missed out on the smartphone revolution, has had quality control problems with its chips, lost customers like Apple, and now risks missing out on the artificial intelligence (AI) wave.

People were initially full of confidence in Kissinger

Expectations were initially high for Kissinger, who had shed blood and sweat for Intel. Kissinger joined the company at the age of 18 and worked at the company for 30 years from 1979 to 2009 before returning to lead the company in 2021. Even some of those who left Intel as a result of Gelsinger’s layoffs said they believed he was the right man for the job. They believe in his strategy to return Intel to chip leadership, they like that he’s an engineer himself, and they like that he’s there to solve long-standing technology problems left (or ignored) by previous CEOs.

Remember Intel’s flagship CPU 486 in 1989? It was the first x86 chip with over a million transistors, and Gelsinger was the chief architect. Later, he became Intel’s first CTO (chief technology officer), helping to promote industry standard technologies such as USB and Wi-Fi as well as Intel chip design.

Before Gelsinger took over the CEO position, Intel was not doing well. After Intel experienced bad bets, multiple generations of chip delays and quality issues, Apple decided to abandon Intel in favor of its own Arm-based chips – which turned out to be a good decision.

Intel has made missteps before: The company has long regretted not putting Intel chips in iPhones, and it also failed to execute successfully on making chips for Android phones. Arguably, it missed out on the entire mobile revolution.

Kissinger’s ambitious goals

In part, Intel’s current situation all boils down to correcting a mistake, the worst-case bet – Intel funded a technology that its competitors used to lead.

More than a decade ago, Intel invested billions of dollars in the Dutch multinational ASML, which has now become one of the most important companies in the chip field. It is the only company in the world that can make the highly complex machines needed to make the most advanced chips – EUV lithography machines. These machines can emit ultraviolet light of very compact wavelengths to efficiently carve circuits on silicon wafers. The process is called EUV.

Intel was initially so confident in the technology that it invested $4.1 billion in the company, but later decided not to order the expensive machines. Yet TSMC placed the order and eventually became the undisputed leader in silicon manufacturing, producing over 90% of the world’s “cutting-edge logic chips.” Samsung has also ordered these machines.

In an interview in 2022, Kissinger did not shy away from calling Intel’s choice “a fundamental mistake.” “We made the wrong bet. How stupid could we be?”

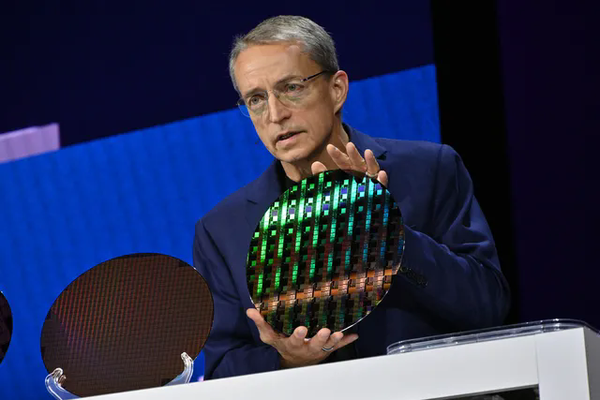

Therefore, Gelsinger decided to embrace EUV while giving his technology arm a blank check to surpass TSMC. “You have an unlimited budget to deliver five nodes in four years. We will regain undisputed process leadership.”

Kissinger wants to build the capacity to mass-produce chips. He plans to invest tens or even hundreds of billions of dollars in new factories in the United States. Eventually, he aims to offer chip manufacturing services to competitors, ensuring these factories remain in business.

Since then, “Five nodes in four years” has become Intel’s slogan. Gelsinger promised that Intel would launch five generations of products in just four years, each with smaller transistors. If you’re familiar with Moore’s Law, you know shrinking circuits to fit more transistors is key to chip improvement. Historically, Intel shrank chip sizes every two years, following the “tick-tock” cycle. A five-year reduction in just four years is an extremely ambitious goal.

What’s more, Gelsinger isn’t just promising to catch up, he’s promising that by the end of his four-year plan, in 2025, Intel will once again lead in silicon technology.

Intel in trouble

Intel has been “on schedule” to deliver five nodes in four years, but the cost has been staggering. Billions of dollars were poured into foundries, and Intel faced multiple missteps. As a result, the company’s market cap has halved, and morale has suffered.

“The layoffs over the past two years have destroyed morale. You make it through one round, then wonder if you’ll be eliminated in the next 3-6 months. This psychological pressure forces people to do the bare minimum, become apathetic, and eventually leave,” said a former Intel employee. (In August, Intel announced it would lay off more than 15,000 employees and cease all non-essential work.)

Intel plans to lay off more than 15,000 employees

Intel’s core business remains profitable, but revenue has declined. Two former employees pointed out that Intel invested heavily in its future foundry business while cutting costs on current products. One claimed that Intel’s Meteor Lake and Arrow Lake CPUs were supposed to feature an “Adamantine” cache, which could have helped beat the competition. “This would have been significantly more competitive, enough to beat Zen 5, but it was cut due to costs.”

It’s unclear whether Intel still leads the chip industry. The concept of “lead” has shifted, and Intel isn’t prepared. Nvidia has become the world’s most valuable company, thanks to its success with artificial intelligence. AMD has also gained ground. Meanwhile, Intel’s Gaudi AI accelerator has struggled to meet Gelsinger’s reduced revenue target of $500 million per year.

In an era where data center businesses focus on GPUs instead of CPUs, Intel is making little progress. Its spending on graphics has yet to yield results. “This takes revenue from the data center business, which is desperately needed to fund this costly strategy,” said a former insider.

Intel’s reputation has also taken a hit. Two generations of desktop CPUs were found to be vulnerable to permanent damage. Its latest processors faced performance issues, and Microsoft followed Apple’s lead by abandoning Intel chips for its new devices. Microsoft also partnered with Qualcomm to launch the Copilot+PC plan.

Intel’s overhauled Lunar Lake laptop chips appeared competitive and allowed the company to catch up with the competition. However, Intel later revealed that the chips were a financial mistake. They were a one-off product that relied too heavily on external partners, including rival TSMC.

Even in terms of silicon technology processes, Intel may struggle to beat TSMC when the “18A” process hits the market next year. The New York Times reported on Kissinger’s departure.

A chip industry source familiar with Intel’s progress shared that Intel recently informed customers that its most advanced processes, 18a and 16a, are far behind TSMC. The source stated that 30% of TSMC’s cutting-edge 2nm chips have no defects, while less than 10% of Intel’s 18a chips are defect-free.

And, this isn’t the first time reports have suggested that 18A may not be ready yet.

Intel misses the AI wave again

Did Intel not foresee the future of artificial intelligence? Why didn’t we catch the AI wave?

It is, but it could have caught the wave. “They acquired some very good companies and they built a GPU called Ponte Vecchio for high-performance computing,” said Patrick Moorhead, principal analyst at Moor Insights & Strategy. “But Ponte Vecchio was designed for floating-point operations, which is not useful for high-performance computing.” The large language models that are driving today’s generative AI craze are not useful, he explained. “The market is shifting to lower-accuracy TOPS.”

“AMD can quickly redesign their products and architecture, but Intel can’t, and that’s the problem,” Moorhead said. “I don’t think that’s their focus.”A former insider mentioned that Intel has made acquisitions but struggled to integrate them, especially Nervana, which developed inference chips to compete with Nvidia. However, the project was abandoned.

Moorhead noted there’s nothing “wrong” with Intel, but the future of artificial intelligence looks bleak. “How can your data center business shrink when Nvidia’s market cap is soaring and AMD is thriving?” While Intel is developing other AI products, such as Falcon Shores set for 2025, the company has missed several opportunities in the AI space, much like it missed the mobile market years ago.

Board of Directors disappointed with Kissinger

Why expel Kissinger now? Sources from Reuters, Bloomberg, and the New York Times reported that Intel’s board lost confidence in Pat Gelsinger’s plan. “Directors believe his costly, ambitious plan to turn around Intel is failing. Change is not happening quickly enough.” Gelsinger’s resignation came after the board decided his turnaround efforts were not yielding results.

Bloomberg highlighted concerns about Intel’s product quality. At a recent meeting, the board discussed the lack of products that could capture the market. They also noted that Gelsinger’s push to transform Intel into a custom chip manufacturer may have overlooked this issue.

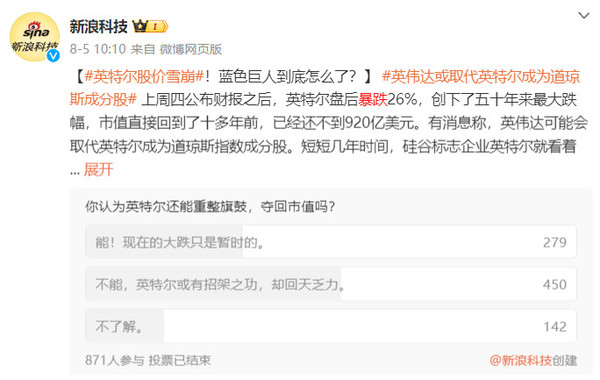

Intel’s financial situation worsened. Despite posting a profit of $2.7 billion in 2023, the company faced losses in 2024. In Q1, it lost $437 million. In Q2, it lost $1.6 billion, and in Q3, it reported a staggering loss of $16.6 billion, a record low. While much of the loss was due to restructuring charges, the financial results and poor forecasts for Q2 2024 disappointed investors. Even layoffs couldn’t stop the stock price from plummeting 26% in one day.

Public scrutiny has increased after Intel’s losses and layoffs. The New York Times and Reuters recently published lengthy articles questioning Kissinger’s leadership. The articles were titled “White House Makes Big Bet on Intel. Will It Backfire?” and “Inside Intel, CEO Pat Gelsinger botched the resurgence of an American icon.” Intel also faces several lawsuits from investors over its previous predictions.

Moorhead and a former insider told Revealed that one reason investors (and the board) may have lost confidence is that Gelsinger predicted the worst-case scenario too early. This confused investors. The austerity measures announced in 2022 resulted in wage cuts and freezes to save jobs, followed by layoffs in 2024.

Both Moorhead and Creative Strategies analyst Ben Bajarin believe Gelsinger’s departure was sudden. “The board must have decided he wasn’t going to stay,” Moorhead said.

His hunch is that Intel’s board may want to completely spin off its foundry business, not just the split Gelsinger has announced. This would turn Intel into a company that designs chips, like its competitors.

Intel’s prospects appear slim

Intel rival AMD set a precedent in 2008 by becoming a “fabless” chipmaker. It spun off its manufacturing operations to a company called GlobalFoundries. GlobalFoundries originally served AMD and is now the third-largest chip foundry in the world. Intel considered GlobalFoundries as a potential acquisition target in 2021.

However, Intel can’t easily spin off its foundries now. The company has received nearly $8 billion in CHIPS and Science Act funding from the U.S. government. The funding prevents Intel from making stock buybacks for the next five years. The U.S. Commerce Department must oversee any change of control. If Intel’s stake in a new company falls below 50.1% or loses voting rights, the Commerce Department wants to ensure Intel can still meet U.S. production commitments. This could make a full spin-off difficult.

“The economics of Intel’s foundries are so challenging that I don’t know how Intel will proceed with a spinoff without a significant cash infusion,” Bajarin wrote.